Allianz has expressed strong support for the EU Data Act, introduced as a pivotal step towards harnessing vehicle data for enhanced safety and innovation in transport. The insurer, however, calls for additional regulations to ensure secure and fair data exchange, as discussed at the 11th Allianz Motor Day held on October 17, 2023.

The EU Data Act aims to empower vehicle owners by granting them greater control over their data. Under the new legislation, users of connected cars will be able to demand that data collected by their vehicles be shared with third parties, including insurers. For “easily accessible data,” the Act requires real-time availability.

Klaus-Peter Röhler, Member of the Board of Management at Allianz SE, highlighted the transformative potential of the Act. “We welcome the EU Data Act,” Röhler said. “The law promotes innovation and competition, reinforcing the European digital economy. It embodies the principle of ‘My device, my data,’ which we fully support.”

Allianz anticipates that the Act will drive substantial advancements in car insurance. With detailed vehicle data, insurers can tailor policies more accurately to individual risk profiles, potentially offering more personalised and risk-based premiums. In the event of an accident, real-time data could enable Allianz to swiftly manage claims, from arranging towing services to coordinating medical assistance.

“This could revolutionise the insurance process,” Röhler noted. “By accessing real-time data, we can proactively assist customers during emergencies, providing immediate relief and ensuring better service.”

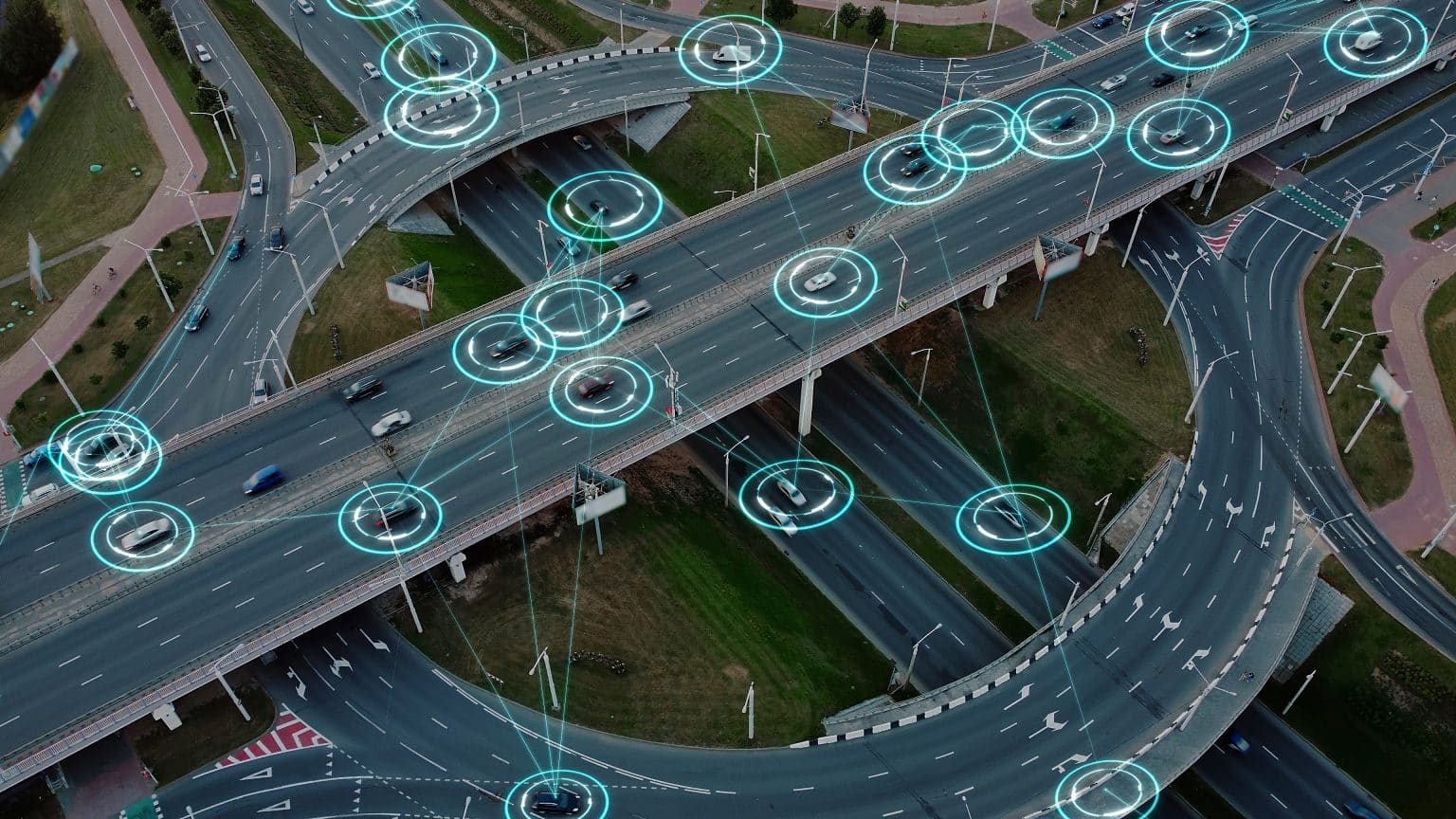

The new law also holds promise for improving road safety and fostering sustainable innovation. Allianz envisions using live data from vehicles to address urban issues, such as parking shortages, thereby contributing to energy savings and environmental benefits. “Properly utilised, vehicle data can make our transport systems safer, cleaner, and smarter,” Röhler added.

A recent Allianz survey across five European countries revealed that a significant number of drivers are open to sharing their vehicle data if they receive comprehensive service support in return. In Germany, 53% of drivers are willing, while in the UK, the figure rises to 61%. “This indicates strong customer trust and willingness to share data, provided we manage it responsibly and transparently,” Röhler said.

However, Allianz stresses the need for a regulated marketplace for data exchange. Röhler pointed out that while the EU Data Act lays the groundwork, further regulation is needed to define the technical and pricing frameworks for data transfer. “For genuine competition and innovation, vehicle manufacturers must charge fair prices for data access. Without this, third parties may struggle to compete,” he explained.

The company also advocates for a clear legal framework to facilitate data transfer. “We need a standardized minimum data set and defined interfaces to make data sharing straightforward and practical,” Röhler said. Allianz proposes the establishment of an independent data trustee to oversee secure data exchange and ensure that all parties have fair access.

In summary, Allianz supports the EU Data Act’s goals but calls for additional measures to ensure transparency, fairness, and efficiency in vehicle data management. The insurer believes that with the right regulations, the Act can significantly enhance both the insurance industry and the broader transportation sector, delivering tangible benefits for consumers and advancing digital innovation.

Contributed by: Business Wire